It behooves a speculator to speculate, and nothing gets the attention of the speculator more than the classic market catalyst of “war in the Middle East.” So last night’s U.S. strike, killing Iranian General Soleimani, is the sort of event that gets markets moving.

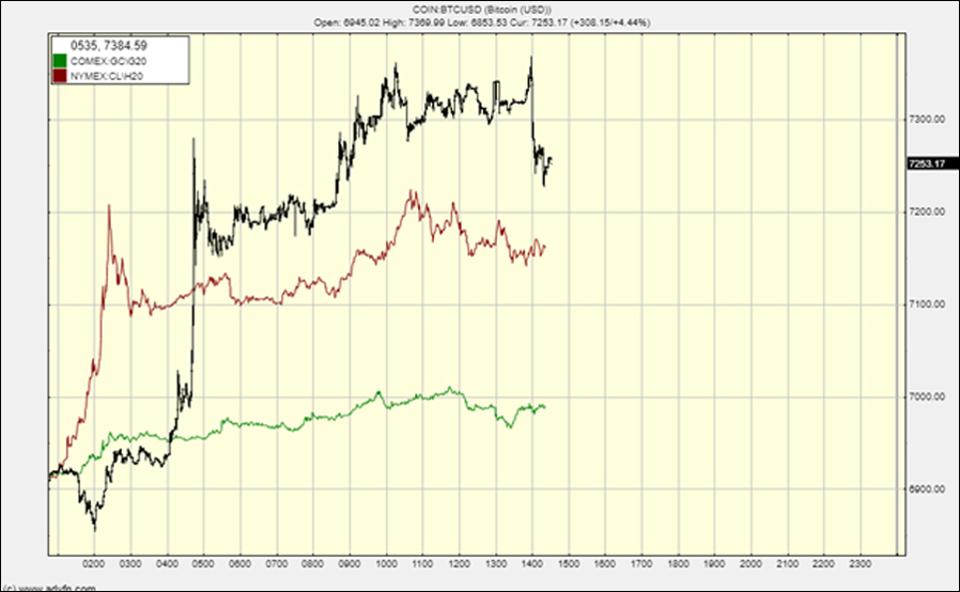

As one might expect, oil jumped and so did gold. Oil is up 3% and gold jumped 2%.

In this new world there is a third safe haven asset, bitcoin (BTC). It is up 5%.

Here is a chart of that action:

This is a very interesting chart because it shows the global professionals reacting to the news much faster than the private traders and it might be suggested this hike is the result of Middle Eastern retail piling into BTC as a flight to safety rather than the relatively non-existent institutional money.

In any event, bitcoin has the most beta in this situation and what’s more there appears to be plenty of time to get your trade on in response to the news.

This, of course, is a gift to all skilled traders, a three-hour warning to buy.

Longer term, however, it is clear to see that in instances where there is trouble in capital controlled countries like Iran and China, bitcoin will be a key asset when times get sketchy.

As such, for those speculators who think of gold and oil as the place to trade when war in the Middle East is on the rise, then bitcoin is the place to be.

For those wanting to trade what might be a U.S./Iran escalation, bitcoin is the place to do your thing because while there are trillions in gold and oil to suck up demand, there is only a smattering of bitcoin to take the sort of buying surge a country like Iran could create were the situation to spin up into a large scale conflict.

Bitcoin is the best place for flight capital and haven capital for those in Iran wishing to protect their assets, and that alone is enough to drive Bitcoin back towards its previous and all-time highs. Then there is the exaggerated Beta of Bitcoin that will draw in the global speculators and their wall of money, so that in an extended and fraught US/Iran conflict only one thing is certain about the price of Bitcoin and that is, it will be far higher than it is now.