Key Takeaways

- 50 Bitcoin that haven’t moved since 2009 were transacted today.

- Some Bitcoin watchers speculate that these coins belong to Satoshi Nakamoto.

- The coins were from Bitcoin mining around a month after the network was created.

BTC from the earliest days of the network moved today. Could Bitcoin creator Satoshi Nakamoto be behind the transaction?

Was Satoshi Behind a Recent Bitcoin Transaction?

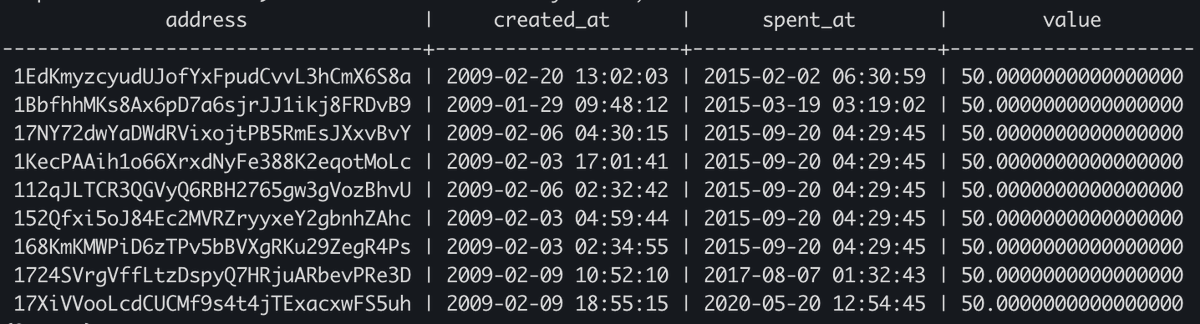

A 50 BTC transaction representing a block reward from a month after the Bitcoin network launched moved today.

The coins were awarded for mining block 3,654. Several pundits have naturally associated that early mining activity with pseudonymous Bitcoin inventor Satoshi Nakamoto.

Others Are Unconvinced

The Block’s head of research, Larry Cermak, believes the transaction is unrelated to Satoshi Nakamoto, identifying that there were several early miners on the Bitcoin network.

Blocks believed to have been mined by Satoshi have a particular pattern in their nonces, a cryptographic number that can help identify blocks. According to that pattern, these Bitcoin do not appear to have originated from Satoshi.

Another analyst noted that the transaction marks the first time that early 2009-origin Bitcoin has moved since August of 2017.

Nevertheless, on-chain sleuths will closely watch the path of the coins as the transaction was undoubtedly from an early Bitcoin miner and large holder. If these 50 BTC continue to move, then a lot more about this story will be revealed.