What you need to know to prepare for the Tron public blockchain migration

Tron (TRX) is currently in the process of moving from the Ethereum Blockchain to their very own independent Blockchain, which is a very big step in the progression of their platform. As of May 31, 2018 the Tron Foundation officially launched the “Mainnet” migration from ERC-20 to the TRX-20 Token but will reach a significant milestone on June 25th when the Tron network will be functioning on its own and will no longer rely on the Ethereum Blockchain to support its transactions and smart contracts.

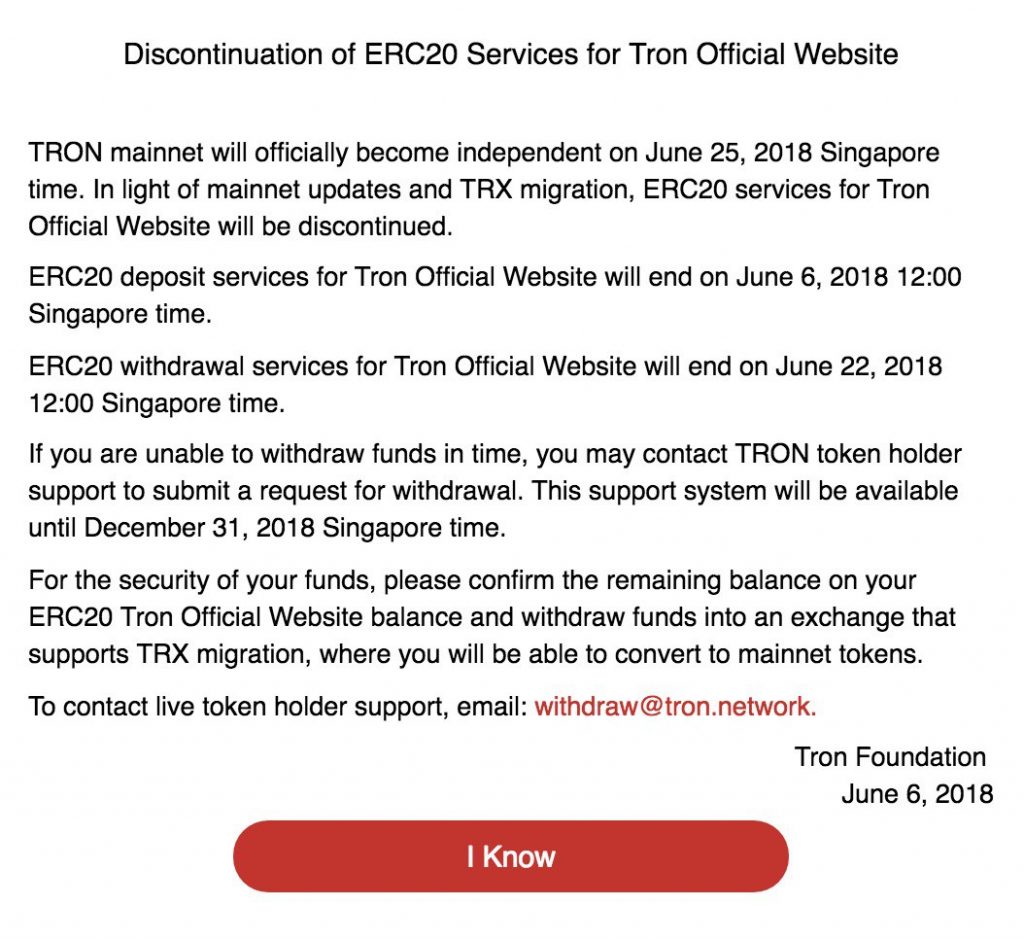

It is important to note that all Tron coin transactions will be frozen from June 22nd to June 24th and the main net will officially become independent on June 25th, 2018.

Is your Tron safe?

In short, Yes. If your Tron is sitting in a reputable exchange like Binance, Bitfinex or Bittrex for example (See the list below for all currently supported exchanges) then your your Tron will automatically be updated from the old ERC-20 token to the new TRX-20 standard token.

If you are unable to withdraw your TRX from the www.tron.network site, you can contact TRON token holder support to submit a request for withdrawal. This support system will be available until December 31, 2018.

What does all of this mean for you?

If you have your Tron sitting on an exchange that does not support the TRX Mainnet then you will need to transfer your token into a exchange that does support the migration in order to swap from ERC20 to official TRX20. (List of exchanges below)

If you have your Tron sitting on a secure wallet or online wallet then you will need to transfer it back into one of many specific exchanges in order to have your Tron converted from ERC-20 to TRX-20. (List of exchanges below)

NOTE: the coin swap will be a 1:1 ratio so you will still have the exact same amount of Tron that you did before.

Exchanges that currently support the new Tron TRX-20 Token

Bitbns, Bit-Z, Bibox, Binance, LBank, Bitfinex, BitoPro, BitForex, Bitthumb, Bitkop, Bittrex, Bixin, Bitpie, Coinegg, Liqui, Coinnest, Coinrain, Cointiger, Dragronex, gate.io, Huobi, Lbank.io, Liqui, OEX, Okex, OTCBTC, RightBTC, Upbit, Zebpay, WazirX