First if you have not already then download the Robinhood App and signup for an account HERE

The world of cryptocurrency has been turned upside down with the announcement of the popular no commission stock purchasing app Robinhood entering the crypto-space. You can now in select states purchase Bitcoin (BTC), Ethereum (ETH) with Litecoin (LTC) and Ripple (XRP) coming soon.

To Buy Bitcoin (BTC) in Robinhood App:

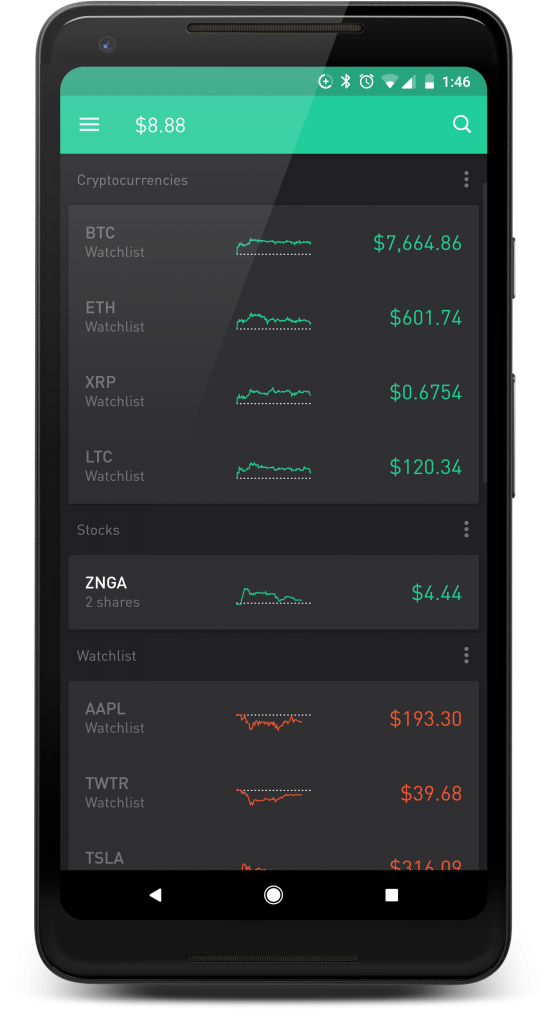

1.Open your Robinhood app and scroll to the cryptocurrency section.

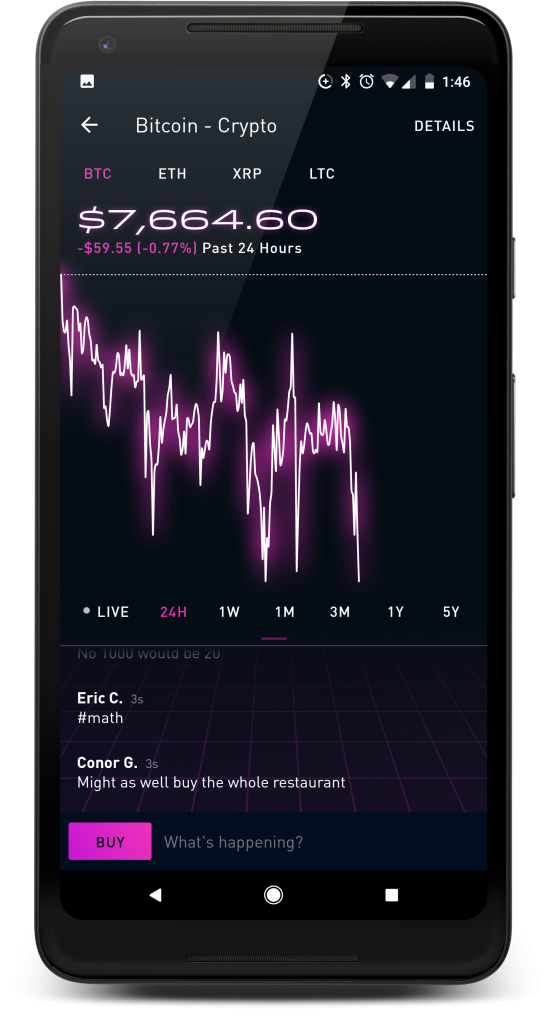

2. Select the cryptocurrency you would like to purchase (currently only Bitcoin (BTC) and Ethereum (ETH) is available to purchase, Litecoin (LTC) and Ripple (XRP) will be coming soon) and click the BUY button at the bottom of the screen.

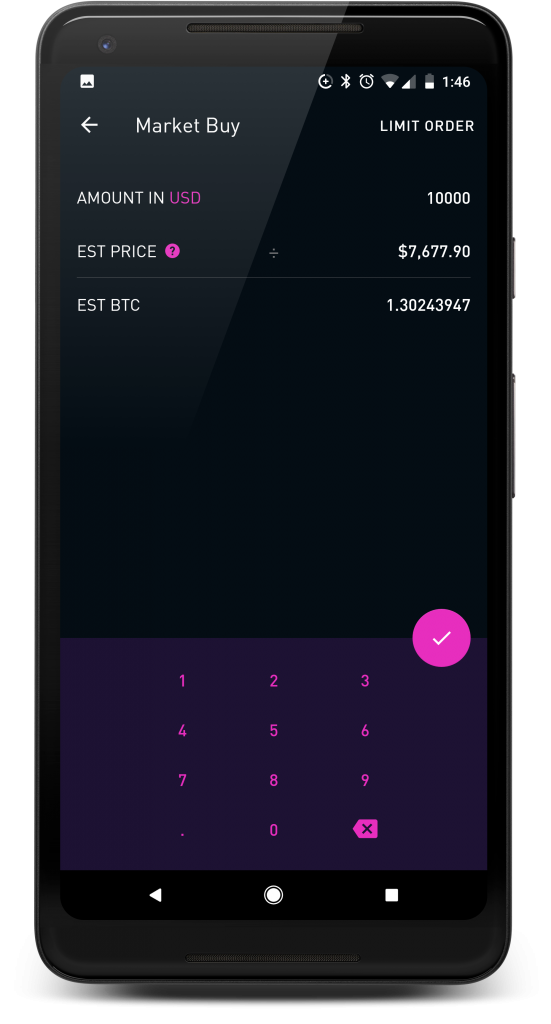

3. Choose the amount of cryptocurrency you want to buy with the Robinhood app and click the check button to confirm your purchase.

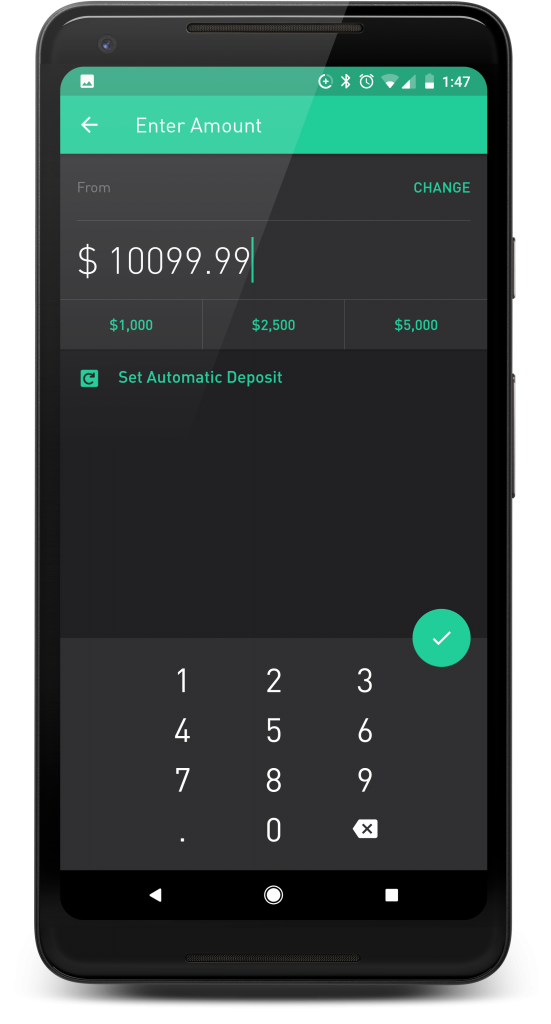

4. If you have not connected a payment source or bank account and funded your account you will be asked to deposit fiat (USD) into the Robinhood app.

5. Once you deposit the money you will be able to confirm your purchase of your selected cryptocurrency!